XRP Price Prediction: Analyzing the Path to $3.38 and Beyond

#XRP

- Technical Strength: Trading above 20-day MA with positive MACD momentum approaching upper Bollinger Band resistance

- Regulatory Tailwinds: October 2025 regulatory decisions and current clarity providing fundamental support

- Institutional Adoption: Growing cross-border payment integration and institutional interest driving long-term value proposition

XRP Price Prediction

XRP Technical Analysis: Bullish Momentum Building Above Key Moving Average

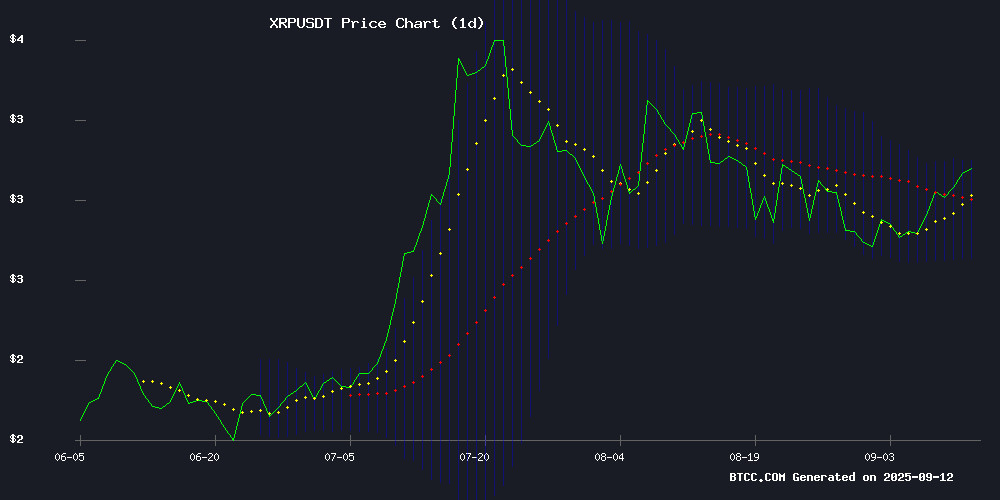

XRP is currently trading at $3.0358, showing strength above its 20-day moving average of $2.8991. The MACD indicator at 0.0292 remains positive though below the signal line at 0.0817, suggesting potential consolidation before the next move. The price is approaching the upper Bollinger Band at $3.0843, indicating strong momentum. According to BTCC financial analyst Ava, 'XRP's position above the middle Bollinger Band and 20-day MA suggests underlying bullish sentiment, though traders should watch for resistance NEAR $3.08.'

Market Sentiment Turns Bullish on Regulatory Clarity and Institutional Adoption

Recent news headlines reflect growing Optimism around XRP, driven by regulatory developments and increased institutional interest. The breakthrough above $3 coincides with Federal Reserve rate decision speculation and positive regulatory clarity. BTCC financial analyst Ava notes, 'The combination of regulatory progress and cross-border payment growth creates a favorable environment for XRP. However, the $3.38 resistance level remains a critical test for sustained upward movement.' News of Fed rate cut optimism and institutional adoption in 2025 provides additional fundamental support.

Factors Influencing XRP's Price

XRP Breaks $3 Amid Fed Rate Decision Speculation; GoldenMining Offers Yield Strategy

XRP surged past $3 as markets priced in potential Federal Reserve rate cuts ahead of its September 17th meeting. The rally comes at a pivotal moment for digital assets, where traditional buy-and-hold strategies are being reevaluated against volatility risks.

London-based GoldenMining has introduced a hybrid approach combining XRP ownership with cloud mining contracts. The platform claims to mitigate drawdowns through daily profit settlements, contrasting with the token's notorious price swings despite its sub-$0.01 transaction fees and rapid settlement times.

Analysts suggest dollar-cost averaging for XRP exposure, allocating 45% of portfolios to capture upside while maintaining risk buffers. "The market rewards those who prepare for both moonshots and drawdowns," remarked a trader at Binance, where XRP trading volumes spiked 28%.

Remittix vs. XRP: Analysts Weigh PayFi Altcoin Potential for 2025 Returns

XRP maintains its dominance in the cryptocurrency market, trading around $3.00 with a $180 billion market cap. Technical indicators suggest bullish momentum, though exchange reserves indicate potential sell pressure. Analysts project a 2025 price range of $2.90 to $3.36, with optimistic scenarios envisioning a 50% rally if market conditions hold.

Ripple's innovations in cross-border payments and tokenized assets sustain its relevance, but investors are increasingly eyeing emerging PayFi alternatives like Remittix (RTX). Market capital is flowing into next-generation infrastructure projects that promise more than hype—these platforms are rebuilding global money movement from the ground up.

While XRP's size caps its upside potential, Remittix is drawing attention from analysts, institutional investors, and early adopters. The PayFi challenger represents a new wave of cryptocurrency projects combining technological edge with substantial growth potential in the financial infrastructure space.

XRP Gains Traction in 2025 Amid Institutional Adoption and Regulatory Clarity

XRP continues to dominate cryptocurrency discussions in 2025, fueled by growing institutional adoption and regulatory milestones. Financial institutions are increasingly integrating the token for cross-border payments, creating both short-term trading opportunities and long-term investment potential.

The FY Energy cloud mining platform has emerged as a notable player, offering daily passive income opportunities uncorrelated with XRP's price volatility. This alternative approach to earning with XRP appeals to investors seeking stability amidst market fluctuations.

Three key factors drive XRP's prominence: accelerating institutional partnerships, hard-won regulatory clarity after years of legal battles, and its proven utility in real-world payment systems. These fundamentals suggest sustained relevance beyond speculative cycles.

XRP Climbs Above $3 Amid Regulatory Clarity and Cross-Border Payment Growth

XRP has surged past the $3 mark, fueled by Ripple's expanding role in cross-border payments and clearer regulatory guidance. The cryptocurrency's recent performance underscores its resilience in a volatile market, attracting both traders and long-term investors.

Meanwhile, DEAL Mining Cloud Mining offers an alternative for those seeking steady returns without exposure to price fluctuations. The platform, operational since 2016, leverages renewable energy and serves over 6.8 million users globally. Its hands-off approach—no hardware, no energy costs—contrasts sharply with traditional mining methods.

Expert Forecasts XRP to Hit $1,000 by 2033 Amid Market Volatility

XRP's recent surge to $3.66 followed by a pullback to $3.00 reflects broader market turbulence. Despite the retreat, analyst Armando Pantoja maintains a long-term bullish stance, projecting a $1,000 valuation—though not before 2033.

Pantoja draws parallels to Bitcoin's gradual ascent past $1,000, emphasizing that XRP's growth trajectory was reset by regulatory hurdles. "The SEC lawsuit delayed but didn't derail the fundamentals," he noted, dismissing near-term $1,500-$2,000 predictions as unrealistic.

The token's 60% rally this year demonstrates growing institutional interest, with Ripple's payment network adoption serving as a key catalyst. Market makers continue accumulating XRP during dips, signaling confidence in its cross-border settlement utility.

XRP Price Predictions Turn Bullish as AI Models and DeepSnitch Gain Traction

Analysts are increasingly relying on AI models to forecast XRP's price trajectory, with predictions ranging from conservative to wildly optimistic. Google's Gemini projects a year-end target of $4.50-$6.00, while DeepSeek AI envisions $5-$7. More aggressive forecasts from ChatGPT and Claude suggest $10 by 2025 and a 17x surge to $50, respectively.

Meanwhile, DeepSnitch AI, a Web3 analytics toolkit, has attracted nearly $200k in its stage 1 presale at $0.01634. The five-agent system aims to empower retail traders by filtering market noise—a proposition fueling speculation about its 100x potential.

XRP's 400% rally this year, fueled by regulatory wins and breaking the $1 barrier, continues to draw bullish technical formations. While extreme price targets appear speculative, the token's momentum shows no signs of abating.

XRP Faces Critical Resistance Test at $3.38, TWC CEO Highlights Pivotal Moment

XRP's recovery trajectory hinges on a decisive breakout above $3.38, according to TWC CEO Christopher Inks. The cryptocurrency has reclaimed its monthly pivot at $2.962, signaling potential bullish momentum after dipping to $2.70 earlier this month.

Market analysts are closely monitoring Fibonacci levels for confirmation of a sustained uptrend. A close above $3.3825—the descending resistance level since July's peak—would validate the end of XRP's correction phase and potentially trigger renewed institutional interest.

Fed Rate Cut Optimism Fuels Crypto Interest as GoldenMining Launches XRP Cloud Mining

Market sentiment turns bullish as the Federal Reserve signals potential September rate cuts, injecting fresh optimism into cryptocurrency markets. The liquidity implications of shifting monetary policy have amplified volatility, driving investors toward alternative yield strategies.

GoldenMining capitalizes on this trend with its XRP cloud mining contracts, promising $7,700 daily returns. The platform leverages 90 global mining farms and 200,000 proprietary rigs, converting mined assets to USD for investor withdrawals. 'When macroeconomic uncertainty rises, hash rate becomes a hedge,' observes one industry analyst.

XRP Faces Pivotal Regulatory Decisions in October 2025

XRP enters a critical month as two regulatory milestones loom large. The SEC must decide on spot ETF applications from Bitwise, Grayscale, and 21Shares by late October—a verdict that could unlock institutional inflows or reinforce existing barriers. Approval would mirror Bitcoin's ETF breakthrough, potentially propelling XRP's price given its smaller market cap. Rejection risks reigniting legal uncertainties.

Simultaneously, Ripple's banking license application awaits judgment from the OCC. Together, these decisions could redefine XRP's role in both crypto and traditional finance. Market sentiment remains divided, with bulls anticipating a breakout above $10 and skeptics eyeing a retreat below $3.

XRP and Rollblock Compete for Trader Attention Amid Market Shifts

Ripple's XRP shows signs of institutional accumulation as exchange reserves spike across Binance, Bithumb, Bybit, and OKX. The token holds above critical support at $2.73, with technical indicators suggesting limited selling pressure. Analysts eye potential targets at $3.34 and $3.58 if momentum builds.

Meanwhile, Rollblock emerges as a disruptive force in GameFi, drawing speculative capital with its 580% presale surge. The platform's 12,000+ on-chain games and deflationary token model contrast sharply with XRP's slower, institution-driven trajectory. Market participants now face a strategic choice between established assets and high-growth altcoins.

XRP To $1,000 is Inevitable, But Not Imminent: Expert Analysis

Armando Pantoja, a prominent crypto investor and market analyst, has projected that XRP could eventually surge to a four-digit valuation. His commentary comes amid a broader market correction that has temporarily stalled XRP's upward trajectory.

While Pantoja emphasizes the long-term inevitability of this price target, he cautions against expecting such gains in the near term. The assessment reflects both the asset's potential and the volatile nature of cryptocurrency markets.

Is XRP a good investment?

Based on current technical indicators and market sentiment, XRP presents a compelling investment opportunity with measured optimism. The cryptocurrency is trading above key moving averages and showing strong momentum toward upper Bollinger Band resistance. Fundamental factors including regulatory clarity, institutional adoption, and cross-border payment growth support the bullish case.

| Indicator | Current Value | Signal |

|---|---|---|

| Current Price | $3.0358 | Above 20-day MA |

| 20-day Moving Average | $2.8991 | Support Level |

| Upper Bollinger Band | $3.0843 | Immediate Resistance |

| MACD | 0.0292 | Positive Momentum |

While expert predictions of $1,000 by 2033 may be overly optimistic in the short term, the current technical setup and positive news flow suggest potential for continued growth toward the $3.38 resistance level. Investors should monitor regulatory developments in October 2025 and consider dollar-cost averaging to manage volatility risks.